Microwave Backhaul: Current and Future Trends

What’s happening in Microwave Backhaul? According to the Ericsson Mobility Report Q4 2017, 3.3 billion mobile broadband subscribers will be added in the next five years, and a clear majority of these will come from LTE and 3G/HSPA in microwave-centric markets. The addition of an Indian greenfield LTE/4G operator and the densification needed to support proper MBB services will increase the number of sites, stabilizing microwave share on a global basis.

The large-scale 5G volume deployments are initially expected in areas with high fiber penetration, such as China, Korea, Japan and US.

There are also operators in Western Europe that have a combination of microwave and fiber, and are looking at introducing 5G. Larger volume rollouts of 5G networks are planned for a later point in the next few years.

Backhaul media distribution (excluding China, Japan, Korea and Taiwan)

In mature mobile broadband regions such as Western Europe, there are

examples of large operators using up to 80 percent microwave that now

plan for 5G introduction using existing microwave networks. Microwave

technology has evolved to manage the demand of mobile networks,

and can do so from any macro site. Core and inter-city aggregation

networks are typically deployed with fiber backhaul, while spurs are

implemented using microwave. It has also been observed that usage of

lower spectrum for longer-distance hops is decreasing in favor of

higher-frequency bands for short distance and high-capacity hops.

Spectrum trends up to 2025

Spectrum below 3GHz will provide coverage in 5G. The 3–5GHz spectrum will enable high bandwidth balanced with good coverage. These bands are not used by microwave today to any major extent (apart from some 4 and 5GHz long-haul links). The extreme bandwidths in 5G will be enabled for hotspots and industry applications in spectrum above 20GHz.

It is clear that the main focus will be on bands 24–42GHz. In the US the FCC currently has a 24, 28 and 38GHz focus and in Europe there is a focus on 26GHz. 3GPP is specifying 5G bands in 24.25–29.5GHz and 37–43.5GHz in Release 15. It excludes 32GHz and E-band, which are both part of the ITU study and, in a recent report, the FCC stresses the importance of E-band for 5G backhaul. The decision on which bands to use and where, will be unique to each nation. But longterm parts of the 24–42GHz spectrum will be used more by 5G and less by microwave fixed services. In some of these bands, e.g. 26 and 38GHz

in Europe, there are many existing microwave links in several countries.

It will take time to move these links to other bands such as E-band. The 15–23GHz spectrum will remain as the global high-volume microwave bands. E-band will become a global high-volume band, both on its own and in a multi-band booster combination with 15–23GHz.

For long hops and as an economical replacement to fiber, 6–13GHz will also remain important. Due to their good propagation properties in geographical areas with high rain rates, these low frequencies are fundamental to building transport networks in certain regions.

With all of this taken into account, it is clear that the availability and usage of microwave spectrum will go through a major transformation in the next 5 to 10 years

Higher Capacities: Radio Link Aggregation

When combining data over multiple carriers, radio link bonding is a key technology. An efficient bonding technique ensures that a single data stream is seamlessly transmitted across different radio channels, with negligible overhead. In the current Global market: About 80 percent of links are configured as single carriers (1+0), the remainder as multi-carrier links with backup links as protection. About 8 percent are set up with one active radio and the protection link in hot standby mode (1+1); 10 percent are configured with dual-carrier radio link bonding (2+0), where the capacity of the backup link is used to increase the link’s peak capacity. Only 2 percent are configured for three or more carriers (>2+0). Due to the need for increased transport capacity, the number of links aggregated over two or more carriers is rising globally.

Total Cost of Ownership (TCO) and Return-on-Investment (ROI)

The total cost of ownership and time-to-market becomes critical to

secure the overall operator business case. As fiber investments typically

have a depreciation of around 25 years, and 5–8 years for microwave,

it becomes important to invest in fiber within the right areas, such

as core and aggregation networks, which historically have been

deployed with long-haul microwave.

Technology Evolution for Microwave

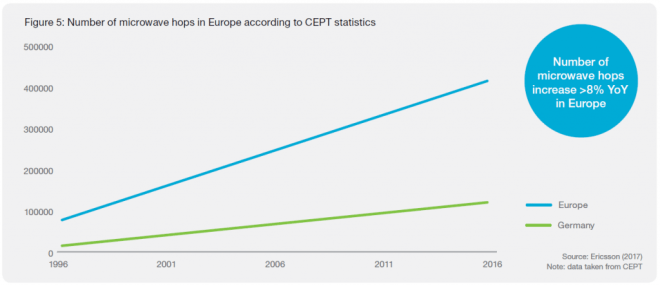

Over the past 20 years, microwave technology has been continuously

evolving to meet requirements. In 1996, microwave hops typically

supported 34Mbps, whereas today products have the ability to support

up to 1Gbps in traditional bands, and up to 10Gbps with E-Band.

Acknowledgement

Some content is (C) Ericsson reproduced with thanks, from Ericsson Mobility Report Q4 2017

For Further Information

For More Information on Microwave Links, Please Contact Us

You must be logged in to post a comment.